Could extra diversification take the sting out of inflation?

21 December 2021

6 minute read

Inflation may only be one factor when it comes to investing but underestimating its damaging effects can blow a hole in your expected returns.

And as we’ve seen in the past few months, inflation is running hot – and it’s expected to remain at these elevated levels, or higher, for some months to come.

Historically, high inflation has been trouble for bonds. Equity valuations can be hit as well. While persistent high inflation can also start to influence stocks and bonds similarly – and, if they start to move in tandem – what does that mean for the traditional 60/40 equity-bond portfolio if everything’s correlated and nothing acts as a ballast to ride out market bumps?

In order to prepare for different scenarios over the next 12 months, we investigate the inflation outlook and which asset classes might best shield portfolios in an inflationary world.

Inflation in the spotlight

Currently, one of the main questions facing investors is whether the recent inflation spikes are merely transitory or might become more permanent.

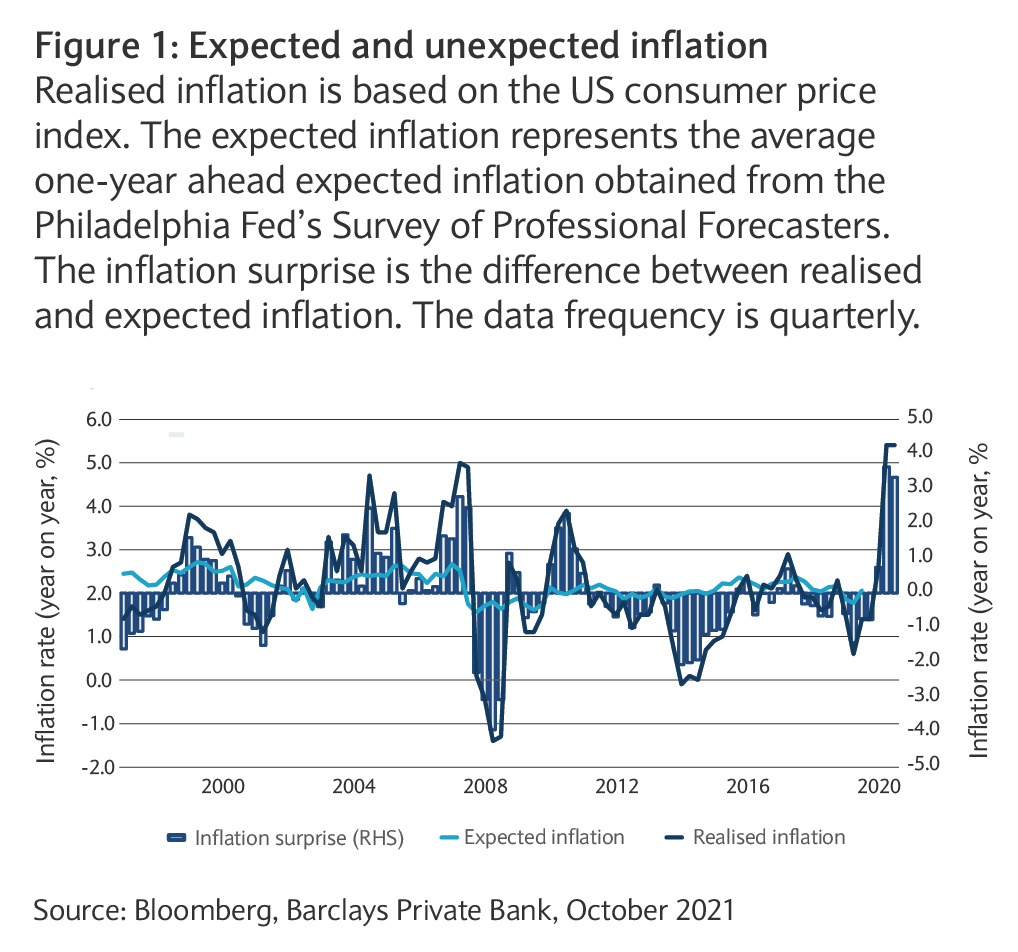

Our analysis below is based on asset return sensitivities (or betas) to unexpected inflation over a one-year horizon. Arguably, at any point in time, expected inflation is already “priced in” by financial markets. Therefore, we investigate how to position portfolios optimally against any significant inflation surprises.

Inflation across developed countries has remained relatively weak since the global financial crisis of 2007-09 (see Figure 1). Over the past decade, muted inflation has lulled many investors into a false sense of security.

But following the reopening of economies last year after their COVID-induced lockdowns, inflation has started to tick upwards once again.

This was driven by several factors: from strong pent-up demand, to high household savings, and a massive increase in the money supply. Supply-chain disruptions only amplified the demand-side effects. Finally, the base effect should not be neglected – low prices 12 months ago boosted the year-on-year inflation rate during the global re-opening and recovery.

Inflation prospects

It’s our view that the powerful forces that kept inflation low in the 2010s – ageing populations, suppressed commodity prices, technological changes, and reduced production costs due to globalisation – will bring inflation under control once again.

Therefore, our baseline scenario is that the inflation rise is only transitory, and it’s expected to fade away in the short-to-medium term. However, there are several risks that may yet materialise, and keep inflation elevated for some time.

Geopolitical tensions and trade wars might resurface and offset some of the benefits of globalisation. Government debt is also at historically high levels, and it’s possible central banks will take a more flexible view of inflation over the short-to-medium term as any interest-rate hikes will increase the cost of national borrowing.

Inflation could also result from the transition to a greener economy – so-called “greenflation” – as fighting climate risk and reducing environmental footprints is likely to incur higher costs.

Higher labour costs associated with wage increases, and costs associated with investments in equality and diversity, could also be another factor driving inflation.

Tackling inflation through diversification

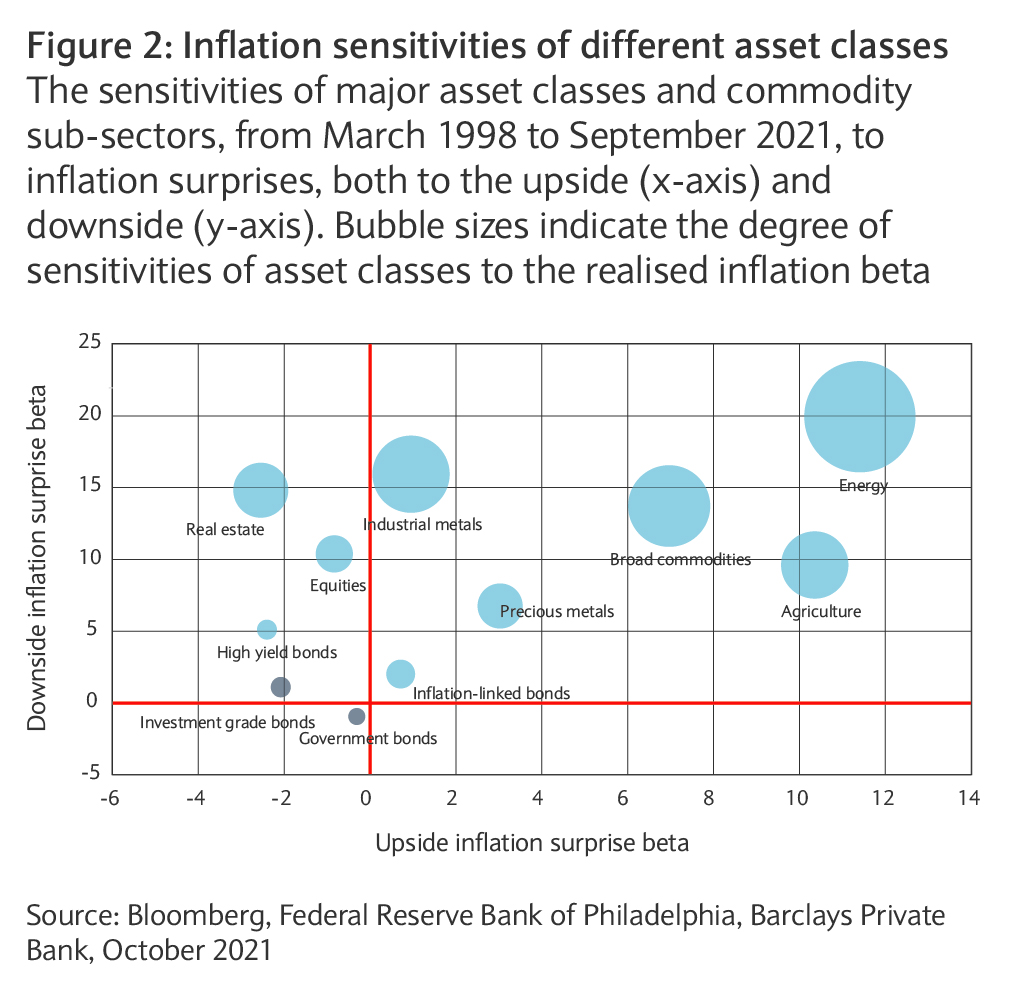

Measuring inflation beta, or the sensitivity of an asset class to realised inflation, can help us understand which assets might be used as an inflation hedge – and potentially protect your investments from a risky situation.

However, to build an effective hedge against unexpected inflation, an understanding of how different asset classes react to upside and downside inflation surprises is needed.

We consider only significant deviations from expected inflation – over 0.5% in either direction (see Figure 2). This is because it’s difficult to disentangle small inflation surprises from other factors that can influence asset performance, such as economic growth.

The potency of commodities as an inflation hedge

Commodities are typically the best hedge against upside inflation surprises (see Figure 2), with energy and industrial metals outperforming when there is an unexpected spike in inflation. This is to be expected, as these commodity sub-sectors are the key inputs in the industrial production process.

Precious metals can also be used as an upside inflation hedge. And although they do not perform as strongly as energy when inflation spikes, they are one of the best choices among commodities as a downside-inflation hedge. This is a reason why gold is considered as one of the best portfolio diversifiers.

The convenience of inflation-linked bonds

On an asset class level, inflation-linked bonds (ILBs) represent the second-best inflation hedge. This is unsurprising as ILBs, by design, automatically adjust in a rising inflation environment.

However, it’s important to consider break-even inflation as well, which represents the market-implied future inflation rate.

Short duration might help nominal bonds

On average, nominal bonds are under pressure when inflation spikes because interest rates tend to rise in parallel.

However, losses can be controlled to an extent by overweighting shorter duration bonds in a portfolio, irrespective of their credit risk exposure. Nominal government bonds also tend to provide protection if inflation surprises on the downside.

Stocks that can thrive in periods of high inflation

Investing in stocks provides a direct growth exposure. In the case of rising inflation, companies should be able to pass on higher costs to consumers.

But in practice, this process changes at a different pace for each industry. To gain further insight into how equities react to bouts of unexpected inflation, we extended our analysis to investing styles.

Our results are intuitive – growth and momentum stocks provide the best protection against upside inflation surprises. Quality stocks are neutral to inflation spikes, whereas value, high-dividend and low volatility stocks do not provide protection in strong inflationary scenarios.

In a strong deflationary scenario, none of the equity styles provides protection. This is because such events typically coincide with an economic recession when there’s a usually a sell-off in equities.

Thinking beyond – thinking crypto?

Recently, cryptocurrencies have been flagged by some investors as a potential inflation hedge.

We do acknowledge some similarities between cryptocurrencies and gold, such as uniqueness, scarcity, and transactability. However, it is unclear yet if a parallel can be drawn between the two assets.

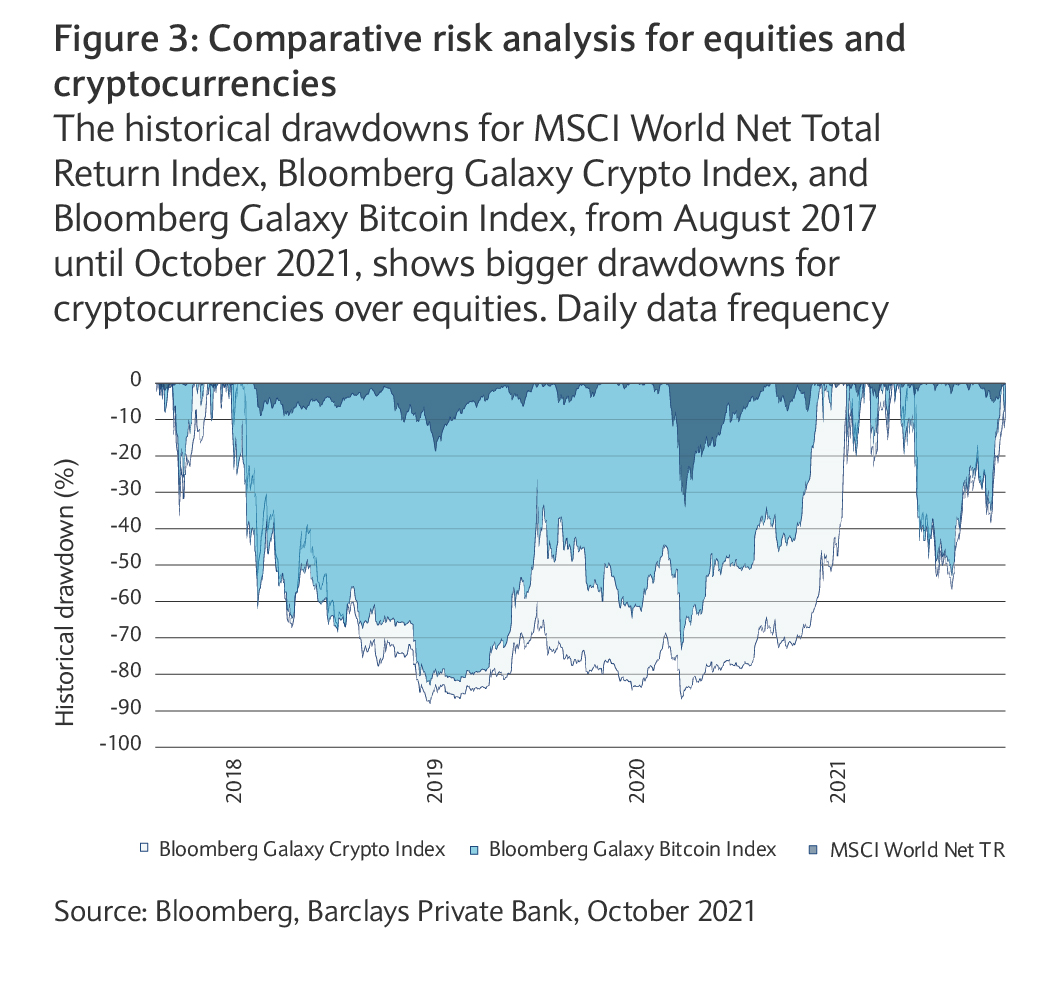

Cryptocurrencies are a recent invention and represent highly speculative digital assets. There are many opportunities, but for most investors the risks are prohibitively high. We estimated the historical drawdowns for bitcoin and a basket of cryptocurrencies over the past four years (see Figure 3).

The maximum drawdowns, or peak-to-trough declines, for crypto was around 80%-90% of the value from their peaks, and the time it would have taken to recover those losses was close to three years. Over the same period, global equities experienced drawdowns of up to 35% and much shorter recovery times.

Additionally, we think the crypto investment landscape is largely under construction and could dramatically change in just a couple of months. It also remains to be seen how the crypto universe will consolidate and address potential regulatory challenges in the future.

Aiming to shield your portfolio from inflation

Therefore, to deal with inflation surprises, one potential solution could be a diversified multi-asset class portfolio including commodities, inflation-linked bonds, selected equity styles, and shorter duration bonds.

Diversification has always been the bedrock of a long-term investment process. But crafting portfolios that are resilient and robust in different macroeconomic environments requires careful consideration of key systematic risks.

Related articles

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.