What 2020 taught us: Should you wait, drip feed or invest all at once?

05 July 2021

8 minute read

With investing, it stands to reason that everyone wants to enjoy the good days and avoid the bad. But timing the market is notoriously difficult.

When there’s short-term volatility, getting out of the market until the dust settles or waiting for the right moment to invest can both prove costly. The worst days tend to rear up without warning, while the best are just as difficult to spot.

Take the dramatic drop in the stock market caused by the COVID-19 pandemic in 2020, and the strong recovery since. Few would have predicted either scenario.

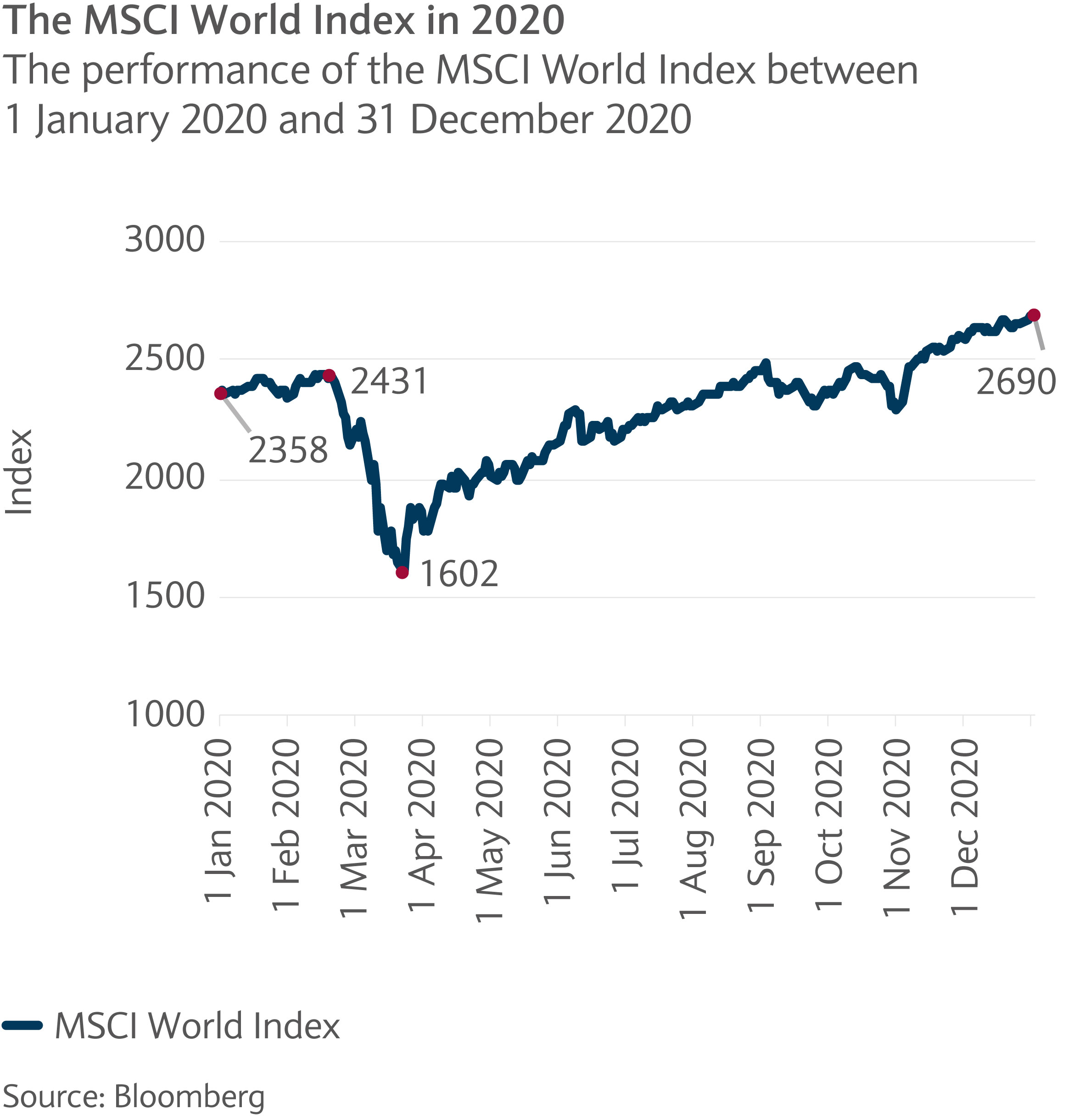

The MSCI World Index, which tracks stocks across the developed world, started January 2020 at 2,358, rising to 2,431 at its 19 February peak – before falling 34% to its 23 March low of 1,602. A spectacular rise of 68% then took it to 2,690 on the last trading day of the year, ending up 14% for the whole of 2020. Quite an eventful ride.

Of course, this is just one year – and an extreme one at that. But it illustrates well how markets can sometimes behave.

The dangers of staying in cash

Holding on to cash can seem comforting in times of turbulent markets, and you’ll generally have easy access to your money should you ever need it. While waiting patiently for the ‘right’ time to invest may feel like the best thing to do.

There are periods where holding cash would outperform being invested. But as the MSCI World Index showed last year, many of its best trading days followed soon after the sharp market falls of March 2020.

Of course, without hindsight, it would be extremely difficult to predict this market low point – especially as it was in the midst of the deadly first wave of COVID-19. But not investing soon after this low point would have meant missing out on much of the subsequent market recovery of 2020.

There is also a hidden cost to holding cash – the erosion of real value due to inflation – which increases with the rate of inflation and the time period held for. At present rates, holding a sum in cash for 10 years would erode your wealth by 10%, requiring a return of 26% just to regain the original purchasing power1.

In essence, sitting on cash could be putting your wealth into reverse, as the rising cost of living overtakes it and historically low interest rates leave it gathering dust.

Phasing in investments can add comfort plus returns

For nervous investors, one way to avoid market timing issues is to invest regularly – rather than all upfront – by ‘drip-feeding’ money in. This buys you into the market during the various ups and downs – and can help nervous investors to get started.

Entering according to defined timelines can be a sensible approach, with a common one to split up a lump sum into equally-sized investments made at regular intervals over a given period.

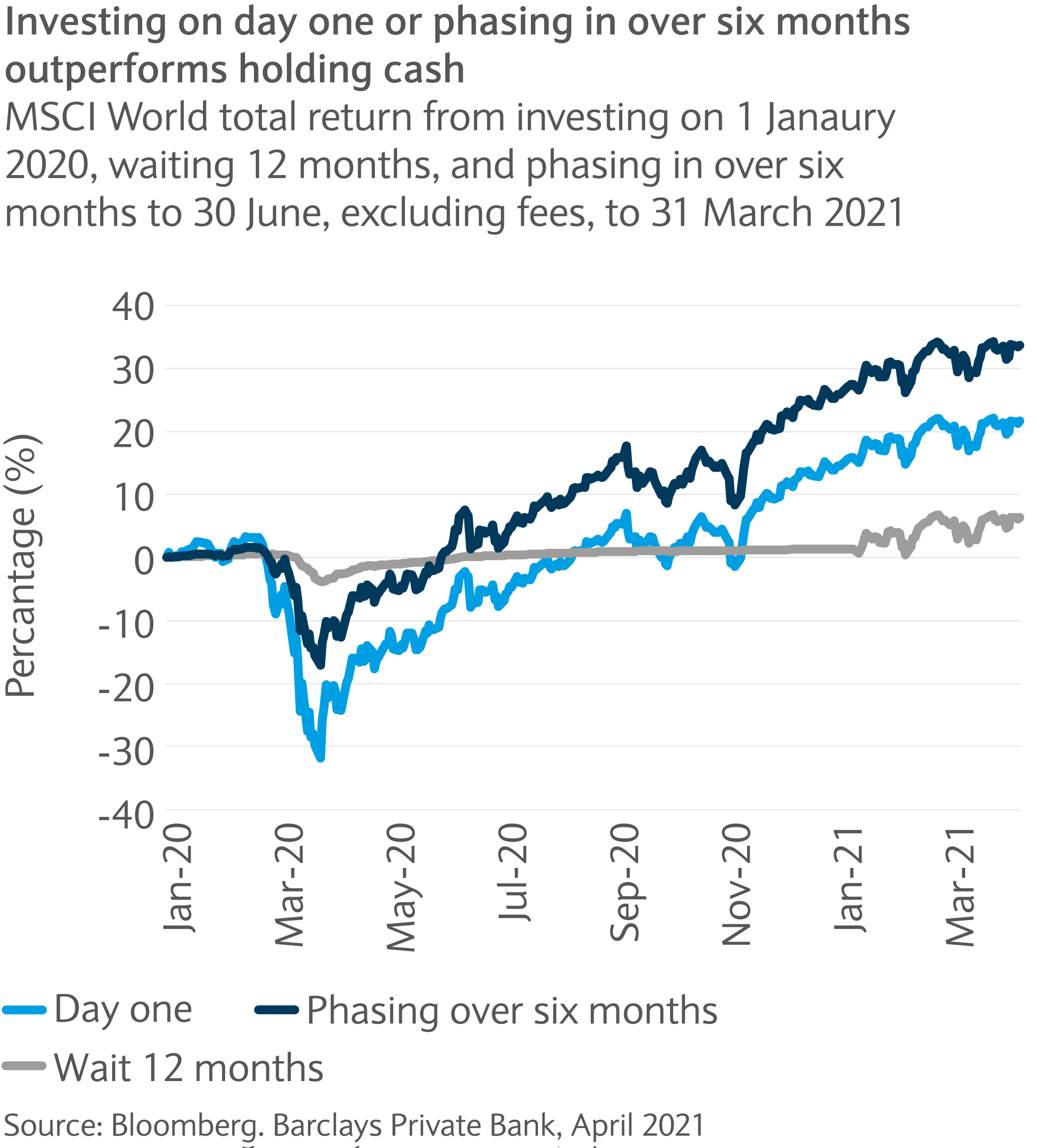

An investor phasing their investment in 2020 into six equally-sized trades on the MSCI World Index at the start of the month, from January to June, would have returned 34% to 31 March 2021, compared with 22% for the day one investor – due to some lower entry points. Interestingly, holding fire last year and sitting on your cash, and only investing on the first day of 2021 returned just 6% to the end of March.

One could point to a scenario of waiting less and getting invested on 1 July 2020, avoiding the downturn but capturing more of the recovery. But waiting to invest always risks missing out on potential returns in the meantime.

The last decade: finding a more ‘representative’ year

In investing, there’s no such thing as a representative year2. But going back a decade to 2010, as markets were starting to recover from the global financial crisis, we examine the impact of phased investments on returns over the following decade.

Investing a lump sum on 1 January 2010 on the MSCI World Index would have realised a 201% return on your initial investment by 31 March 2021. Whereas phasing over the first six months of 2010 would have returned a slightly higher 206% by 31 March 2021.

More striking is the impact that waiting 12 months to get invested made. Holding off until the start of 2011 lowered the overall returns to 173% by 31 March 2021.

Clearly the past doesn’t dictate the future and this example only references equities, but the core concept of avoiding trying to time investments perfectly, is worth focusing on.

Time in, not timing, the market counts

Being invested and maximising the time that your money has in the market may therefore provide the best chance of meeting your long-term goals.

It also means you’ll be less tempted to run for the hills during turbulent times. And staying invested means you’ll be able to benefit immediately from any recovery.

Staying invested often pays off

As with waiting, the success of phasing versus getting invested on day one is governed by the market performance in that given year. In 2020, it reduced the volatility experienced while boosting returns, whereas in other years it may have been better to invest all at once.

And given the historical long-term direction of markets has been up and the power of compounding, it pays to invest sooner rather than later. Waiting for a more opportune entry point for getting invested has risks.

We believe that investors maximise the chances of reaching their financial goals by investing with a long-term perspective in a diversified portfolio comprised of quality companies. While markets can be volatile, putting money to work quicker increases an investor’s investment horizon, maximising the chances of receiving returns closer to the long-term averages, which have been better than cash.

Nevertheless, for investors who may have concerns about getting invested in markets, phasing investments in gradually is certainly worth considering.

For more information, please do contact your Relationship Manager. You can also find more of our insight and analysis on our News and insights page.

Related articles

Investments can fall as well as rise in value. Your capital or the income generated from your investment may be at risk.

This communication:

- Has been prepared by Barclays Private Bank and is provided for information purposes only

- Is not research nor a product of the Barclays Research department. Any views expressed in this communication may differ from those of the Barclays Research department

- All opinions and estimates are given as of the date of this communication and are subject to change. Barclays Private Bank is not obliged to inform recipients of this communication of any change to such opinions or estimates

- Is general in nature and does not take into account any specific investment objectives, financial situation or particular needs of any particular person

- Does not constitute an offer, an invitation or a recommendation to enter into any product or service and does not constitute investment advice, solicitation to buy or sell securities and/or a personal recommendation. Any entry into any product or service requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding documents

- Is confidential and is for the benefit of the recipient. No part of it may be reproduced, distributed or transmitted without the prior written permission of Barclays Private Bank

- Has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Barclays is a full service bank. In the normal course of offering products and services, Barclays may act in several capacities and simultaneously, giving rise to potential conflicts of interest which may impact the performance of the products.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation. Law or regulation in certain countries may restrict the manner of distribution of this communication and the availability of the products and services, and persons who come into possession of this publication are required to inform themselves of and observe such restrictions.

You have sole responsibility for the management of your tax and legal affairs including making any applicable filings and payments and complying with any applicable laws and regulations. We have not and will not provide you with tax or legal advice and recommend that you obtain independent tax and legal advice tailored to your individual circumstances.

THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.