Making sense of recent market volatility

09 February 2022

5 minute read

Market turbulence like we’ve seen so far this year can feel uncomfortable, but there are many reasons not to panic.

Volatility is a common feature of investing, especially in stock markets. Market corrections – typically defined as a fall of +10% from the most recent peak – occur frequently. Looking at historical performance, the S&P 500 index has experienced one roughly every 12 months. Despite these setbacks, over the past 20 years, the index has produced a total return of more than 450%, or 9% per year (based on our in-house assessment of historical Bloomberg data as of 27 January 2022. Past performance is never a guarantee of future performance).

Overall market volatility, as measured by the VIX index, is still comparatively low. But after a period of strong positive returns since the pandemic-driven sell-off in March 2020, it may feel worse than it is, simply because we are not used to it.

We do expect to see further bouts of volatility this year, but these should be relatively short-lived.

What’s behind the current volatility?

As the world adjusts to living with COVID-19, central banks are moving from survival mode, to a focus on stabilisation. With inflation rising, keeping interest rates at such low levels is no longer viable. This shift in stance is, not surprisingly, unsettling markets after an extended period of unlimited support.

The prospect of interest rate rises initially hit high-growth, low-profitability stocks the hardest, as their valuations are more dependent on future cash flows, but the sell-off has since become more widespread as investors have become more risk-averse.

What can we expect for US rates?

At a press conference on 26 January, the US Federal Reserve (Fed) signalled it would start raising interest rates in March, and adopted a more hawkish tone. Investors have been expecting rates to rise in 2022 for some months, but the number of hikes priced in by the market has gradually increased, from one back in October, to as many as five following the recent update.

While many investors took the Fed’s statement to be “more aggressive than usual”, we are more balanced in our interpretation of the message. If inflationary pressures ease later this year as we expect, we believe the Fed will adapt accordingly and slow the pace of any policy normalisation.

Five reasons to be positive about equity markets

1. The market may be overestimating future rate hikes

In our view, the Fed has done much of the hard work in preparing the market for rate hikes. With close to five hikes now priced in for this year, we think there’s a higher chance of the Fed under-delivering (rather than over-delivering) on the market’s expectations.

Source: Bloomberg, Barclays Private Bank. January 2022

Please note: Forecasts are not a reliable indicator of future performance. The value of investments can fall as well as rise and you may get back less than you invested.

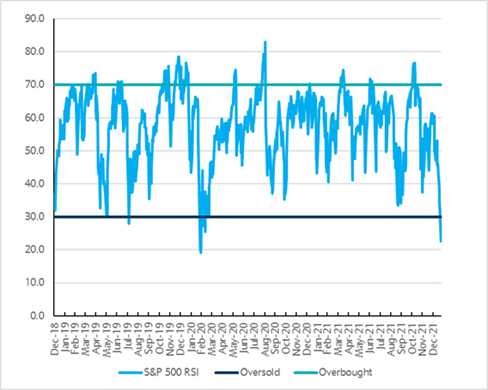

2. Investors may have oversold

The market sell-off this year has been fast and deep, and may well have gone too far. The S&P 500 Relative Strength index is currently at very oversold levels, close to those seen in the pandemic-fuelled decline in March 2020.

Source: Bloomberg, Barclays Private Bank. January 2022

Please note: Past performance is not an indication of future performance. The value of investments, and any income can fall, as well as rise, so you could get back less than you invested. Neither capital nor income is guaranteed.

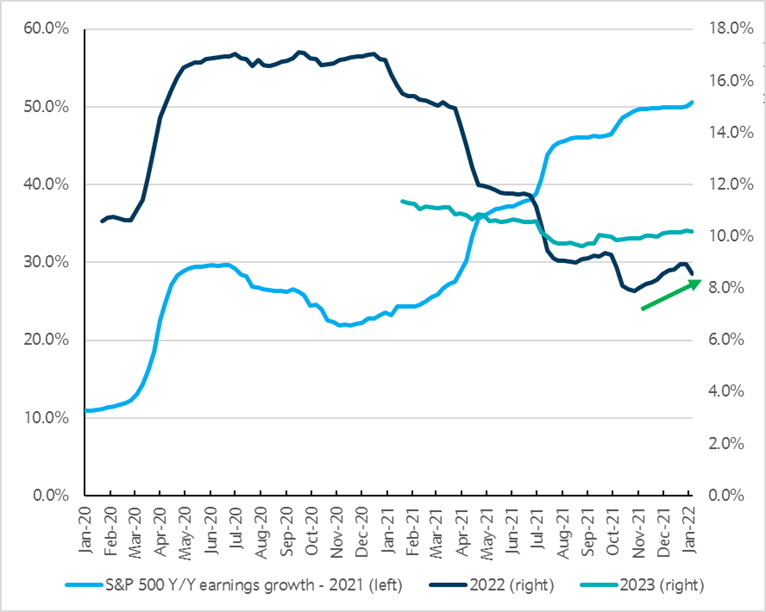

3. Corporate earnings expectations are still positive

The latest US earnings season is progressing well. About 50% of companies have reported quarterly results, and are on track to deliver earnings growth of 24% versus last year, slightly higher than analysts’ consensus. Management guidance has been much better than price action would suggest, and expectations for 2022 earnings remain positive (+8.5% year on year for US companies). (Source: Bloomberg, Barclays Private Bank. January 2022).

Source: Bloomberg, Barclays Private Bank, January 2022

Please note: Past performance is not an indication of future performance. The value of investments, and any income can fall, as well as rise, so you could get back less than you invested. Neither capital nor income is guaranteed.

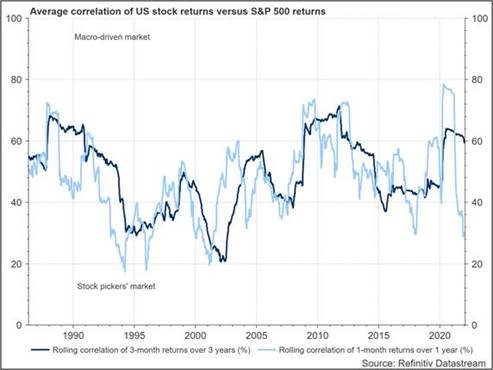

4. In volatility lies opportunity

The correlation between stock returns has fallen dramatically, potentially creating a very favourable environment for stock pickers. Even if the overall market suffers, performance of the underlying stocks may vary widely.

Source: Bloomberg, Barclays Private Bank. January 2022

Please note: Past performance is not an indication of future performance. The value of investments, and any income can fall, as well as rise, so you could get back less than you invested. Neither capital nor income is guaranteed.

5. History shows staying invested pays off

History shows that investors who keep calm during market volatility, and hold their positions for the long term, are likely to be rewarded. By looking at various market setbacks from the past 30 years, it paints a picture of long-term reward when investors stay invested.

Our view

The market volatility we’ve experienced this year was not unexpected. Stock markets rarely move in a linear fashion for long; they tend to swing from optimism to pessimism, often overshooting on each side.

The current environment of high valuations, looming rate hikes, and rising geopolitical tensions makes markets even more vulnerable to large swings.

As such, the recent weakness is nothing to fear. This is, in our view, a case over market overreaction, which should present some attractive buying opportunities for long-term investors.

Related articles

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.