When investors overreact

30 March 2022

4 minute read

Evocative headlines. Economic uncertainty. Market volatility. It’s certainly been something of a rollercoaster ride for investors so far in 2022.

But the problem is, some people have a tendency to react instinctively to negative, short-term events. And it’s this anxiety that can often lead to overreaction in the form of quickly selling investments in the hope of avoiding potential losses

Of course, there may be a natural inclination to sell stocks at such times, but this can prove risky – not least because prices can, and often do, bounce back quickly. And once you’ve exited a market, it’s very hard to time a re-entry that captures the upswing.

In the article below, we explain why keeping a cool head is key to successful long-term investing.

Overreacting to short-term events

Studies have shown that markets can overreact to unexpected and dramatic news events – with this overreaction “effect” larger for negative rather than positive news stories.

This runs counter to the efficient markets hypothesis, which plays a huge role in the way many investors think about how stock markets work. Namely that investors always respond rationally to publicly available information.

Knowing that markets can, on occasion, be “inefficient” – initially at least – will help you navigate such periods better. It stands to reason that if most investors fail to assess rationally the implications of these market-shaking events, it will lead to violent market moves.

But the theory of efficient markets implies that any investor biases will soon fade away – with these overreactions seen only in the short term.

Giving too much bias to recent news headlines

Another thing people tend to do is give more weight to recent news headlines, rather than past events. This can lead them to assigning greater importance to events that are easier to recall.

For investors, it can mean making investment decisions based only on event-specific information, potentially ignoring large amounts of historic data.

Of course, when considering buying an individual stock, it’s wise to form an opinion on any news you receive – but equally you should also apply appropriate weight to its past performance.

Beware of making knee-jerk reactions

Market sentiment, or the general outlook or attitude of investors, also plays an important role in trading behaviour. And when sentiment becomes excessively bearish or bullish, it can prompt knee-jerk reactions from investors.

For instance, if you start paying too much attention to negative news stories, there’s a real danger of creating a self-fulfilling prophecy. It’s how market crashes have started in the past. Similarly, stock market bubbles can also be driven by people listening only to positivity.

It’s also worth noting here that the historic direction of stock markets is upwards. Most stocks do rise over time and are also more likely to rise if there’s been a sell-off. It makes staying invested a better strategy than trying to time the market.

Fear of the unknown can cloud decision-making

Uncertainty, or the unknown, very often leads to higher volatility in the stock market. Higher volatility means a stock’s price is likely to fluctuate more.

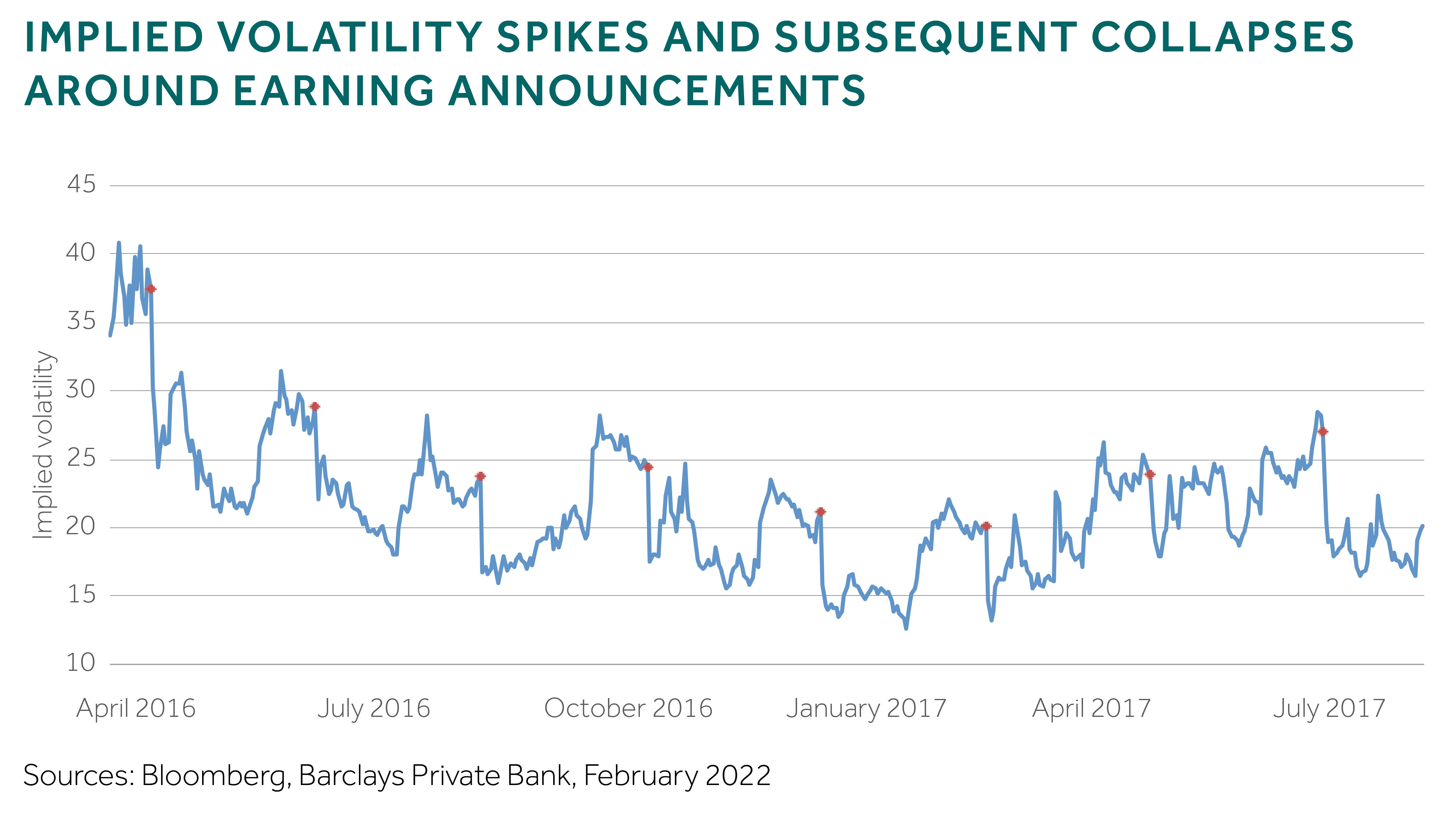

Interestingly, a study of implied volatility around company earnings announcements – at the point where the unknown becomes known – highlighted that uncertainty tends to be over-priced by investors. As the chart below shows, implied volatility generally spikes prior to an earnings announcement, before collapsing after all the information becomes public (after the red dot).

Please note: Past performance is not an indication of future performance. The value of investments, and any income can fall, as well as rise, so you could get back less than you invested. Neither capital nor income is guaranteed.

How to keep your emotions in check

There’s always going to be uncertainty on the horizon. But controlling your emotions is critical to successful long-term investing.

To help with this, we’ve come up with five questions that may be worth asking yourself when faced with unsettling news:

- While the news may be dramatic, is it fundamentally significant to investors?

- Is this event likely to have a long-lasting impact on my portfolio?

- Does market sentiment seem excessively bullish or bearish?

- Am I placing the right weight on this event, versus historical data?

- Am I considering the possible opportunities as well as the risks?

All investors have valid and genuine fears, but the more you research and learn about the stock market – the more you’ll reduce the risk of making poor, short-term decisions which weaken your long-term goals.