Investing in the Paris property market

18 December 2018

15 minute read

Throughouth 2018, perceptions of France among business leaders, higher earners and investors have been changing.

Paris recently overtook London for the first time in Wealth-X’s global league table of cities where the wealthy and well-paid want to live. The exodus of higher earners, both French and international, seen under President Emmanuel Macron’s predecessor François Hollande, appears to have been reversed.

President Macron, who was elected in 2017, has promised to reform the economy, introducing various policies designed to boost growth. For property investors in prime and super-prime property in the French capital, this has been significant. Indeed, the Macron administration’s policies include measures aimed at easing frictions in the property sector.

Recent anti-government protests and a steady decline in Macron’s popularity may limit the potential for further economic reforms. However, France remains an attractive place to live and visit, and its legal stability provides overseas buyers, including investors, with a reassuring backdrop against which to make property purchases.

While the prospect of further unrest may concern property investors, the country appears to be on an upwards trajectory, and house prices in Paris could make further progress.

The political and economic landscape

President Macron has taken several steps to modernise the French economy since his election, implementing labour market reforms, tax reductions and policies supportive of innovation and entrepreneurship.

“The Macron reforms have been undoubtedly well received by the business community and private enterprises, tackling some of the most entrenched problems the French economy has faced for many years,” says Jad Bardawil, Head of Banking and Credit Distribution (EMEA) at Barclays Private Bank. “But the bigger impact is that they have changed the mood and perception, improving optimism among both domestic and overseas investors.”

France’s wealth tax on those with substantial assets has been scaled back and now applies only on property. Also, President Macron is committed to reducing the corporate tax rate from 33.3% to 25% by 2022.

In the housing market, the Macron administration wants to encourage property investment. It has introduced initiatives such as a new ‘mobility lease’, that makes it easier for landlords to offer short-term lets. At the lower end of the market, a move to exempt lower-income households from the ‘taxe d’habitation’ (annual residence tax imposed on the occupier of a property) will encourage increased house buying activity.

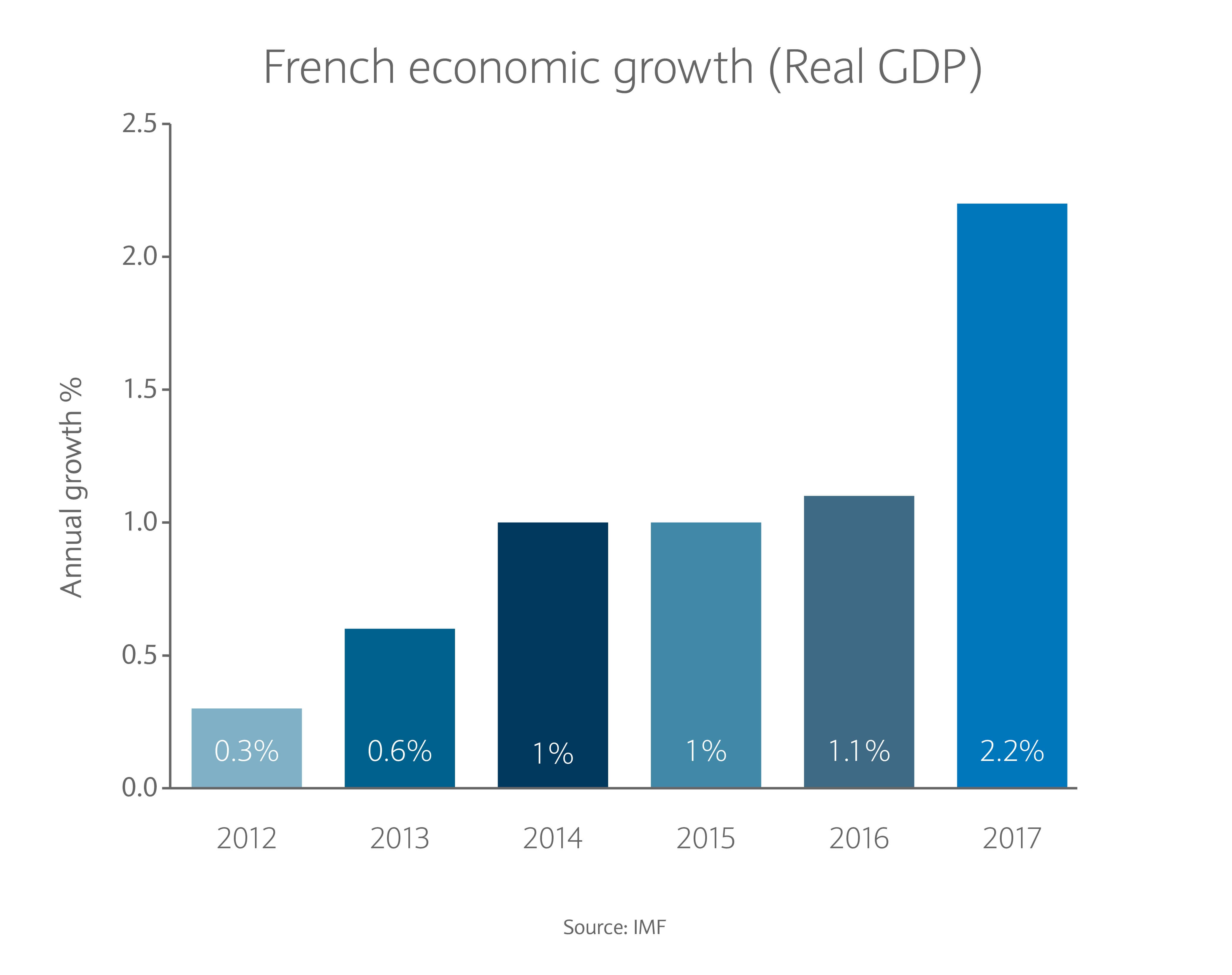

The greater potential for France’s property market lies in President Macron’s determination to finally increase the productivity and competitiveness of the French economy. The International Monetary Fund (IMF), for one, has been impressed. A recent report on the French economy concluded: “France is well positioned to advance its agenda aimed at addressing remaining structural challenges to boost jobs and make the recovery more durable.”1

However, the success of Macron’s reforms, and the potential to make further progress modernising the economy, depend in part on the fallout of the recent ‘gilets jaunes’ (yellow vest) protests that have swept across France in recent months.

Unrest began last year in reaction to a planned rise in diesel fuel duty, but further protests were triggered by a range of issues, from the high cost of living to university reforms. Macron has responded by announcing steps to ease tensions, including measures to boost wages for the low paid and the scrapping of the planned fuel duty rise.

In July 2018, the IMF predicted that the French economy would grow by 1.6%, which would be its best performance since 20112. However, it remains to be seen what impact the recent protests might have on the economy.

Indeed, Paris could perform especially strongly in the future. Think tank Oxford Economics currently ranks the city as the world’s fifth largest urban economy and expects it to retain that ranking through to 2022 despite tough competition from China3.

Overall, France’s strengthening economy could attract significant investment. Barclays’ Jad Bardawil adds: “If President Macron can stay on track with his election reforms, there is a real opportunity to attract investors who had previously not considered France, especially within the current interest rate environment.”

Near-zero interest rates have depressed the value of the euro, particularly against the dollar. Investors buying French property from dollar-denominated income or assets pay 18% less today compared to five years ago, thanks to the dollar-euro exchange rate4. The broader – and continuing – low interest rate environment in many global markets represents an opportunity for investors looking to borrow to invest in Paris real estate.

“The European Central Bank has started its journey in the normalisation of monetary policy by signalling the reduction of its asset purchase programmes,” says Syed Raza, Managing Director, Global Banking and Credit Solutions Group at Barclays Private Bank. “However, it’s likely a cautious approach will be taken, with interest rates expected to remain at historic lows for the next 12 to 24 months.”

Lifestyle factors

The human resources consultancy Mercer lists Paris as the 39th best city to live in worldwide, in a ranking of 450 cities5. The French capital also scores particularly highly on transport, leisure and healthcare infrastructure.

These rankings may improve in years to come as Paris begins to benefit from a major investment programme. The Grand Paris project will overhaul and expand the city’s metro system, with further plans for substantial infrastructure upgrades in the run-up to Paris hosting the Olympic Games in 2024. This offers a further spur for regeneration and investment.

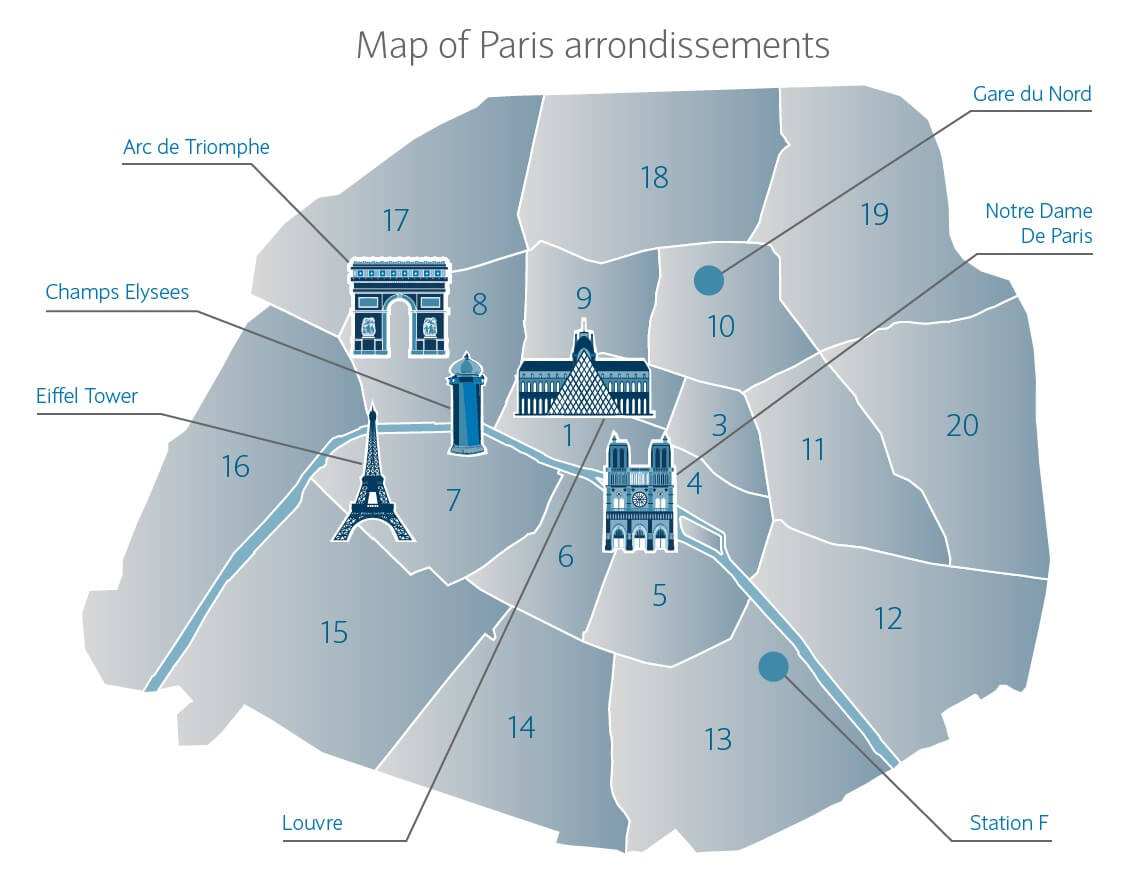

One attraction of Paris is that it offers a range of different types of lifestyle within a small central location. The 16th arrondissement, for example, is seen as particularly attractive to families, with open spaces and several international schools that attract buyers focused on their children’s needs. However, the rest of the city is also well served by educational institutions – there are 48 English-language schools alone in Paris6.

Districts in the north and east of the city are increasingly attracting high-tech businesses and start-ups. Station F in the 13th arrondissement is a 34,000 sq ft site hosting hundreds of start-ups and incubators sponsored by the likes of Facebook and Microsoft.

Focus on the Paris property market

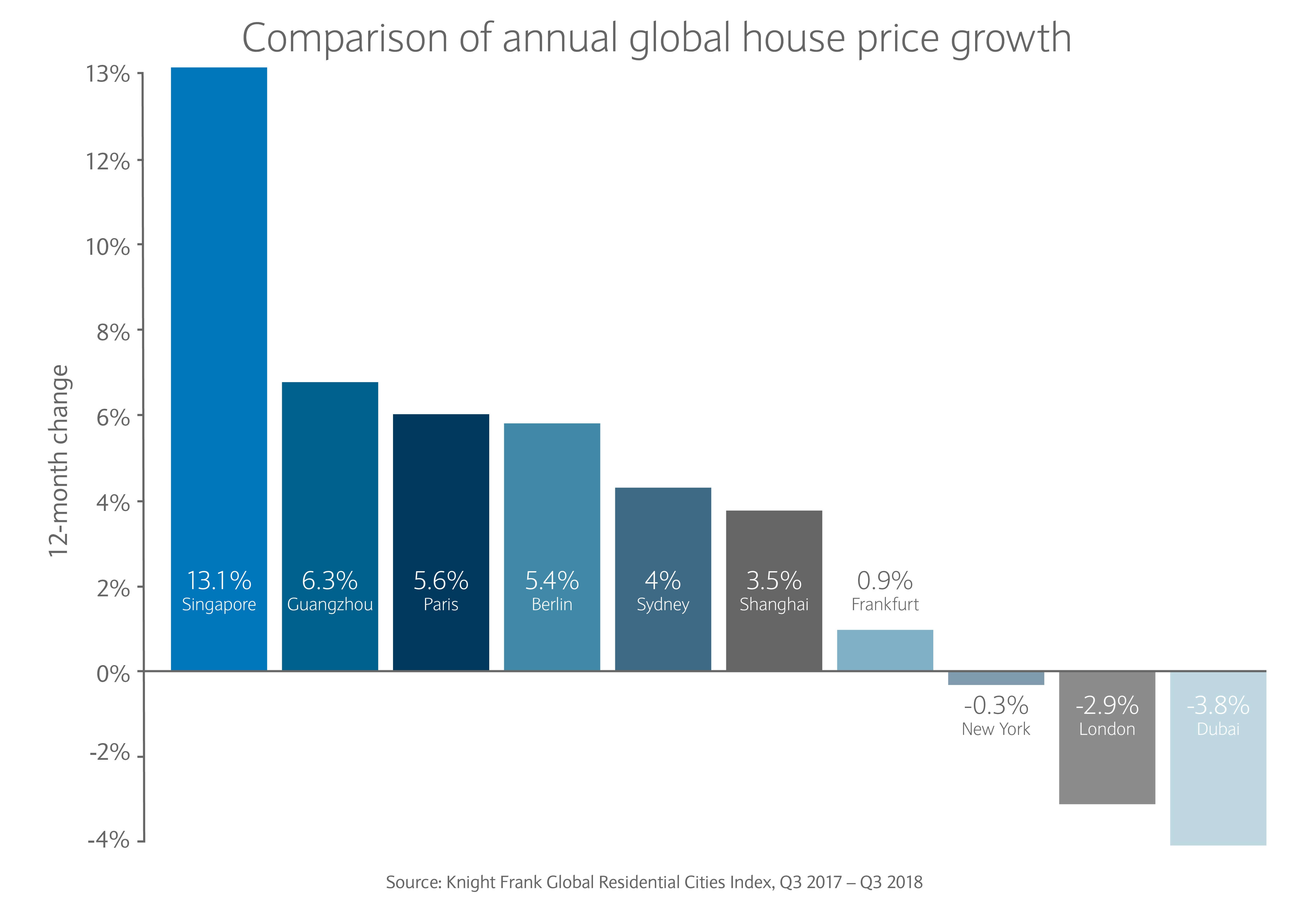

Prime property prices in Paris rose by 5.6% in the 12 months between September 2017 and September 20187, according to the Knight Frank Prime Global Cities Index. The property consultancy is predicting strong gains for the total of 2018, rising 9% over the year as a whole8.

This puts the French capital well ahead of many of its European and global peers. In Europe, Paris outperformed cities such as London, Berlin and Frankfurt in the 12 months to September 2018. Globally, it lagged behind Guangzhou and Singapore, but prices in Paris grew more rapidly than in major cities including New York, Sydney, Shanghai and Dubai. Overall, Paris finished the second quarter in 13th place of the 43 cities in Knight Frank’s ranking7.

Looking forward, the 9% projection for Paris house prices also looks strong compared to other cities – Knight Frank is not predicting greater gains in any other major city. Indeed, London and New York are expected to rise by 0.5% and 0% respectively, with Geneva (3.0%), Berlin (7.0%) and Hong Kong (7.0%) doing better but still not as well as Paris8.

Knight Frank International Associate Partner Roddy Aris says the stars are aligning for Paris, with a sense of optimism driven by the Macron regime and the 2024 Olympics. Buyers are targeting different areas of the French capital, he adds.

"The main arrondissement to have seen the biggest upturn in values is the 16th. During the [President] Hollande years, this is where the main wealth exodus stemmed from. Today it is one of the most sought-after locations for large, Haussmannian family apartments and private houses.

“The aspirational buyer though remains focused on the prime Parisian hotspots of the 4th, 6th, 7th and 8th. Here we are seeing prices breaking previous records. The more intrepid buyer today is focusing on the 2nd and 3rd arrondissements. This is where a large number of start-up and tech companies are setting up business.”

Data from the Paris Property Group supports that argument9. It shows average prices now exceed €10,000 per square metre in the 1st, 2nd, 3rd, 4th, 5th, 6th and 7th arrondissements, with the 8th, 9th and 16th close behind. Prices have climbed steadily in recent times – over the past five years, 12 of Paris’s arrondissements have seen double-digit price growth – but accelerated last year.

International buyers are an important factor in Paris’s rising property market. One in four overseas buyers in France is British10, with the Brexit referendum regarded as likely to boost demand, particularly as Paris courts the financial services sector.

“The remaining three quarters of overseas buyers typically stem from northern Europe,” adds Mark Harvey, Head of European Sales at Knight Frank International. “But buyers from the Middle East, the US and even Asia are also displaying a greater appetite for French real estate.”

Data from the Paris Notaires shows that while the British and the Belgians buy Parisian properties in greater numbers, investors from the Middle East, China and Russia typically make much more expensive purchases11.

Across the city as a whole, transaction volumes have increased sharply. Official data from the Paris Notaires shows there were 38,900 sales in central Paris (inside the Périphérique ring road) during 2017. That’s an 18% increase on the previous year, with volumes moving back towards the record of 43,000 set in 199912.

Outlook

The outlook for prime residential property in Paris is encouraging. Last year saw strong performance, and this is continuing during 2018. The market offers the prospect of both capital appreciation and rental yield.

“The dynamics of the foreign exchange market, particularly the strong dollar, and the low cost of borrowing are in France’s favour,” says Barclays’ Syed Raza. “Investors have every reason to be attracted to France and to Paris in particular.”

France could yet be blown off course. President Macron appears to be making good progress in implementing the reforms he promised during his election campaign, although the recent protests suggest his honeymoon period may have come to an end.

Meanwhile, the fallout from Brexit could see Paris benefit from an inflow of financial services professionals. But there is also scope for negative economic impacts from the global sphere. The international and domestic political and economic environment – with challenges ranging from high unemployment and a polarised electorate to trade wars and diplomatic tensions between countries – could also unnerve the overseas investors on which these markets depend.

However, while Syed Raza believes these potential headwinds should be front of mind for investors in France, they are not sufficient to derail the country’s economy or Paris’s property market. “The forecasts for further growth in volumes and prices are supported by the fundamentals,” he says.

And there are many reasons to remain positive. The quality of life that France offers – and particularly the culture and vibrancy of Paris – will always attract buyers. France’s economy has been strengthening, and its political environment is stable. Borrowing is affordable and currency market movements have boosted the purchasing power of many overseas investors. Moreover, Parisian property looks less overpriced, on a historic and relative basis, than many other hotspots.

Any views expressed may differ from those of Barclays. All opinions and estimates are given as of the date hereof and are subject to change. No representation is made as to the accuracy of the assumptions made within. Barclays is not responsible for information stated to be obtained or derived from third party sources or statistical services.

Barclays is not offering to sell or seeking offers to buy any product or enter into any transaction. Any offer or entry into any transaction requires Barclays’ subsequent formal agreement which will be subject to internal approvals and execution of binding transaction documents. Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.

Barclays is not obliged to inform the recipients of this communication of any change to such opinions or estimates. THIS COMMUNICATION IS PROVIDED FOR INFORMATION PURPOSES ONLY AND IT IS SUBJECT TO CHANGE. IT IS INDICATIVE ONLY AND IS NOT BINDING.

Barclays offers private and overseas banking, credit and investment solutions to its clients through Barclays Bank PLC and its subsidiary companies. Barclays Bank PLC is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register No.122702) and is a member of the London Stock Exchange and NEX. Registered in England. Registered No. 1026167. Registered Office: 1 Churchill Place, London E14 5HP.